To keep employees, freelancers, and contractors engaged, businesses need more than just basic salaries. Workers are increasingly drawn to roles that offer financial incentives beyond their regular pay, such as bonuses, overtime pay, paid time off, and end-of-service benefits. These additional earnings fall under supplemental pay, also known as supplementary wages.

Token Talent, a modern HR and payroll solution, explores how supplemental pay works—especially for companies managing teams in regions like the UAE and Saudi Arabia

What Is Supplemental Pay?

Supplemental pay refers to all financial compensation outside the regular monthly paycheck. Common types include:

- Performance bonuses

- Overtime earnings

- Commission-based pay

- Project completion rewards

- Holiday bonuses

- Severance packages

- Equity or stock options

- Gratuity or end-of-service benefits

While supplemental pay enhances employee motivation, it’s still considered taxable income in most countries. Employers are responsible for managing calculations and compliance based on local labor laws.

Comparing Base Salary and Supplemental Pay

| Compensation Type | Description | Frequency | Purpose |

|---|---|---|---|

| Base Salary | Fixed monthly payment | Regular (e.g., monthly) | Core compensation |

| Supplemental Pay | Additional financial benefits | Variable | Motivation & reward |

Companies in Dubai, Riyadh, or Doha often pair base salaries with flexible bonuses or allowances. This approach supports both employee wellbeing and retention, particularly in highly skilled roles such as software development, finance, and sales.

Supplemental Pay Practices Around the World

Middle East

Businesses across the GCC are known for structured supplemental rewards. For example:

- UAE: Housing and transport allowances are common. Gratuity payments are legally required under the labor law.

- Saudi Arabia: Many firms offer annual bonuses, educational reimbursements, and profit-sharing for top performers.

- Qatar: End-of-service payments are mandatory, and some employers offer relocation bonuses for expatriate staff.

- Egypt: Employees may receive festival or religious holiday bonuses.

Asia

- In China, housing support is often provided.

- Japan offers transportation reimbursements.

- Supplemental pay is usually taxed along with the base salary.

Europe

- In Germany and Italy, a 13th or 14th-month salary is widely practiced.

- Social contributions apply to both base and extra earnings.

United States

- Companies offer varied forms such as profit-sharing, tuition support, and sales commissions.

- Well-documented performance-based schemes are typical.

Challenges in Managing Supplemental Pay for Remote and Cross-Border Teams

1. Miscalculations

Manual errors in calculating overtime, commissions, or bonuses can lead to mistrust.

Solution: Token Talent provides real-time payment previews, reducing uncertainty and mistakes.

2. Tracking Goals and Milestones

When supplemental pay is tied to performance, tracking output becomes complex—especially for international teams.

Solution: Token Talent integrates with tools that measure outcomes like OKRs and MBOs, enabling automated rewards for team members across world.

3. Lack of Transparency

Unclear eligibility and inconsistent communication often cause frustration among employees in different locations.

Solution: Token Talent supports detailed documentation, dashboards, and region-specific payroll policies—ideal for growing teams in the Gulf, North Africa, or South Asia.

Why You Should Implement a Supplemental Pay Strategy

Supplemental pay creates:

- Increased engagement and motivation

- Stronger loyalty and retention

- Alignment between individual goals and company objectives

To be effective, your program must be:

- Transparent: Clearly define who qualifies for what reward.

- Timely: Deliver payments on schedule to maintain momentum.

- Adaptive: Regularly review policies to stay relevant in fast-changing markets.

Companies operating in Dubai tech hubs, Saudi fintech startups, or Egyptian service centers benefit greatly from modern, structured compensation programs that include variable rewards.

Sample Roles & Suitable Rewards

| Role | Suggested Supplemental Pay |

|---|---|

| Web Developer | Stock options, training stipends |

| Sales Rep | Commission, bonus for exceeding targets |

| HR Manager | Wellness perks, annual retention bonuses |

| Marketing Manager | Campaign-based performance bonuses |

| Finance Analyst | Profit-sharing, certification sponsorship |

| Customer Service Rep | Shift differential, customer satisfaction rewards |

| Admin Assistant | Overtime pay, remote workday flexibility |

| Project Manager | Completion bonuses, travel allowance |

These supplemental rewards align especially well with positions based in GCC countries, where employee expectations often include performance-linked compensation.

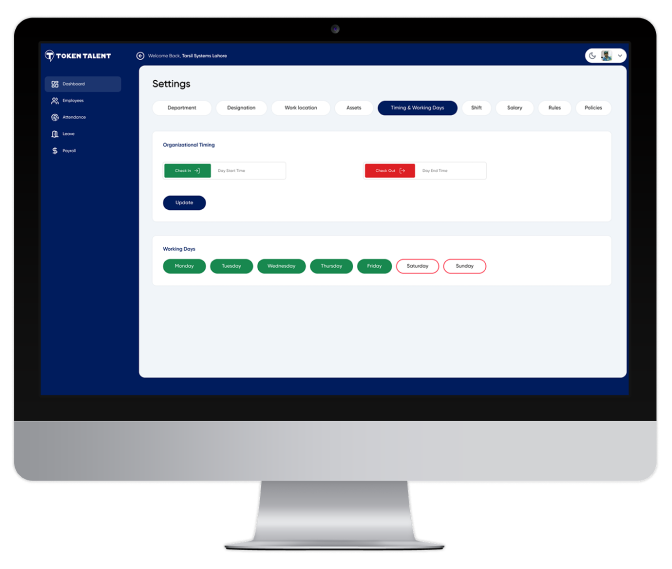

How Token Talent Makes It Easy

With Token Talent, you can:

- Automate bonus, commission, and overtime calculations

- Ensure compliance with Middle Eastern labor regulations

- Customize rules for regional practices like Saudi GOSI contributions or UAE WPS

- Provide multilingual self-service dashboards for transparency

Final Thoughts

In today’s global talent economy, offering supplemental pay isn’t just a perk — it’s a strategy. Whether managing talent in Riyadh, Dubai, Cairo, or anywhere in the world Token Talent gives you the tools to design and execute fair, motivating, and scalable reward systems.

Key Benefits of a Strong Supplemental Pay Strategy:

- Clear, data-backed eligibility rules

- Timely, automated payments

- Regular policy updates tied to business goals

- Cross-border compliance support

- Transparent team communication